Versions Compared

Key

- This line was added.

- This line was removed.

- Formatting was changed.

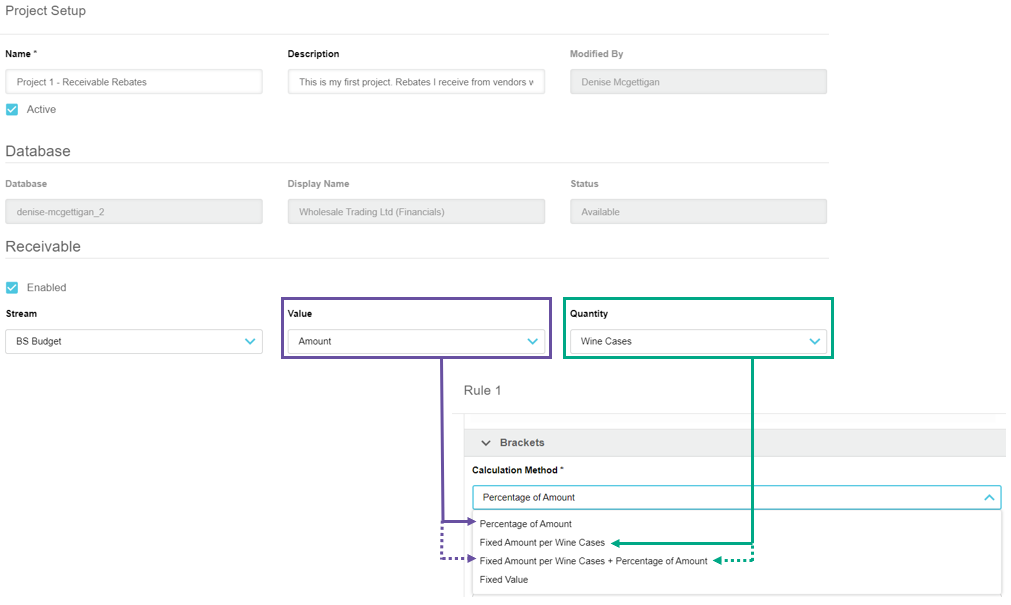

When setting up a rebates rule, in the Brackets > Calculation Method section, you can select one of four calculation methods, as illustrated in the following image and described below.

The specific calculation methods that are available for a rule depend on the Value and Quantity measures that were defined in the project setup.

Percentage

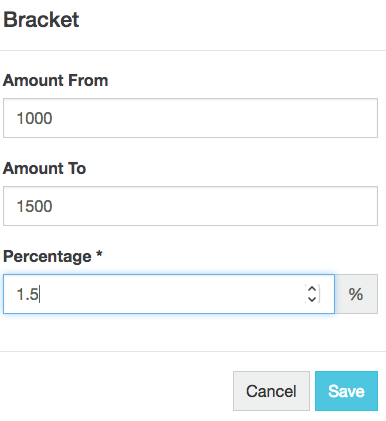

A percentage rebate is applied if a third party, such as a customer or supplier spends (or sells) a certain amount. Every certain amount is spent (a certain target is achieved). Every transaction within the defined bracket(s) receives a percentage rebate based on that value. For example, you might pay a 5% rebate on each dollar spent on sales.

This calculation method applies to the Value measure defined in the project setup. It is typically used when the rebate bracket basis is set to Amount.

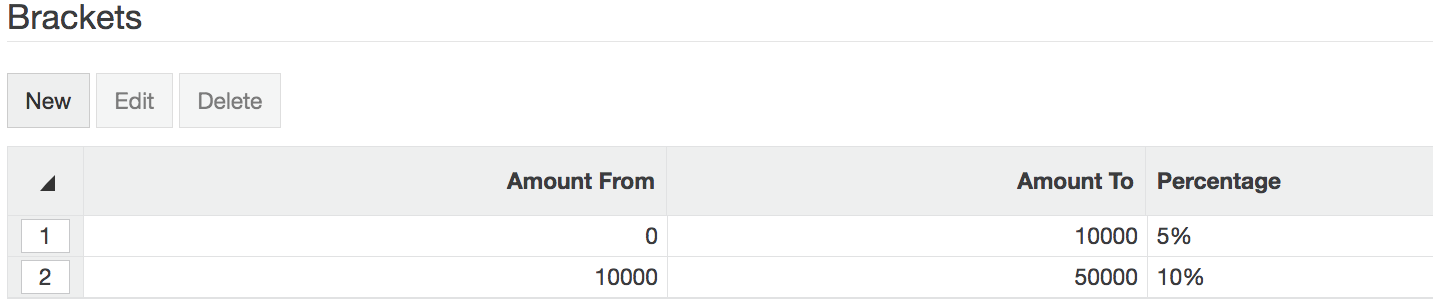

Example - : Assume brackets are set up as : a 5% rebate between $0 and $10,000, and a 10% rebate between $10,000 and $50,000

If the customer has spent $6,000, they'll get a rebate of $300

If the customer has spent $8,000, they'll get a rebate of $400

If the customer has spent $20,000, they'll get a rebate of $1500

Image Removed

Image Removed Image Added

Image Added

Fixed amount

A fixed rebate per item is applied if the third party purchases (or sells) a certain volume or quantity is purchased or sold. Every transaction within the defined bracket(s) receives a fixed rebate. This method is suitable when you're using a measure related to quantity or volume. For example, you might pay a $1 rebate for every unit sold or $500 for every 1,000 pounds sold.

This calculation method applies to the Quantity measure defined in the project setup. It is typically used when the rebate bracket basis is set to Qty.

Example - : Assume the brackets are set up as: $1 rebate between 0 and 100 items, and $2 rebate between 100 and 500 items.

If the customer has bought 20 items, they'll get a rebate of $20

If the customer has bought 80 items, they'll get a rebate of $80

If the customer has bought 120 items, they'll get a rebate of $140

Fixed amount and percentage

The rebate that is applied is based on both a percentage of spend (or sales) plus a fixed amount per item. Every transaction within the defined bracket(s) receives a fixed rebate and a percentage rebate. This method combines the percentage and fixed amount methods. For example, you might pay a 2% rebate on sales plus $1 for each unit sold.

In this calculation method, the percentage applies to the Value measure and the fixed amount applies to the Quantity measure defined in the project setup. It is typically used when the rebate bracket basis is set to Qty.

Example - : Assume the brackets are set up as: 5% + $1 rebate between 0 and 100 items, and 10% + $2 rebate between 100 and 500 items

If the customer has bought 20 items (value $6,000), they'll get a rebate of $320.

If the customer has bought 80 items (value $6,000), they'll get a rebate of $380

If the customer has bought 120 items (100 for $2000 and 20 for $3000) , then they'll get $540

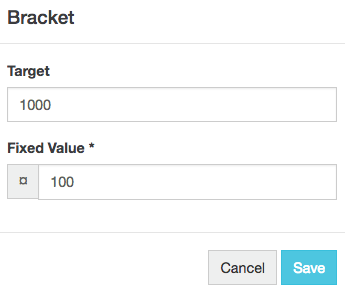

Fixed value

A fixed rebate is applied based on spending ( or purchasing ) a 'certain (target' ) amount. Often This method is often used for annual buying group rebates or marketing contribution rebates. For example, you might have a target of $10,000 in sales for a customer and when the customer reaches that target, you pay a fixed rebate of $500.

When you select a fixed value, all the options except for bracket basis become unavailable (greyed out).

Calculation methods

| Table of Contents | ||||

|---|---|---|---|---|

|